Only for Business Brokers and M&A Pros:

Avoid these 10 most common deal-killers and easily close more transactions

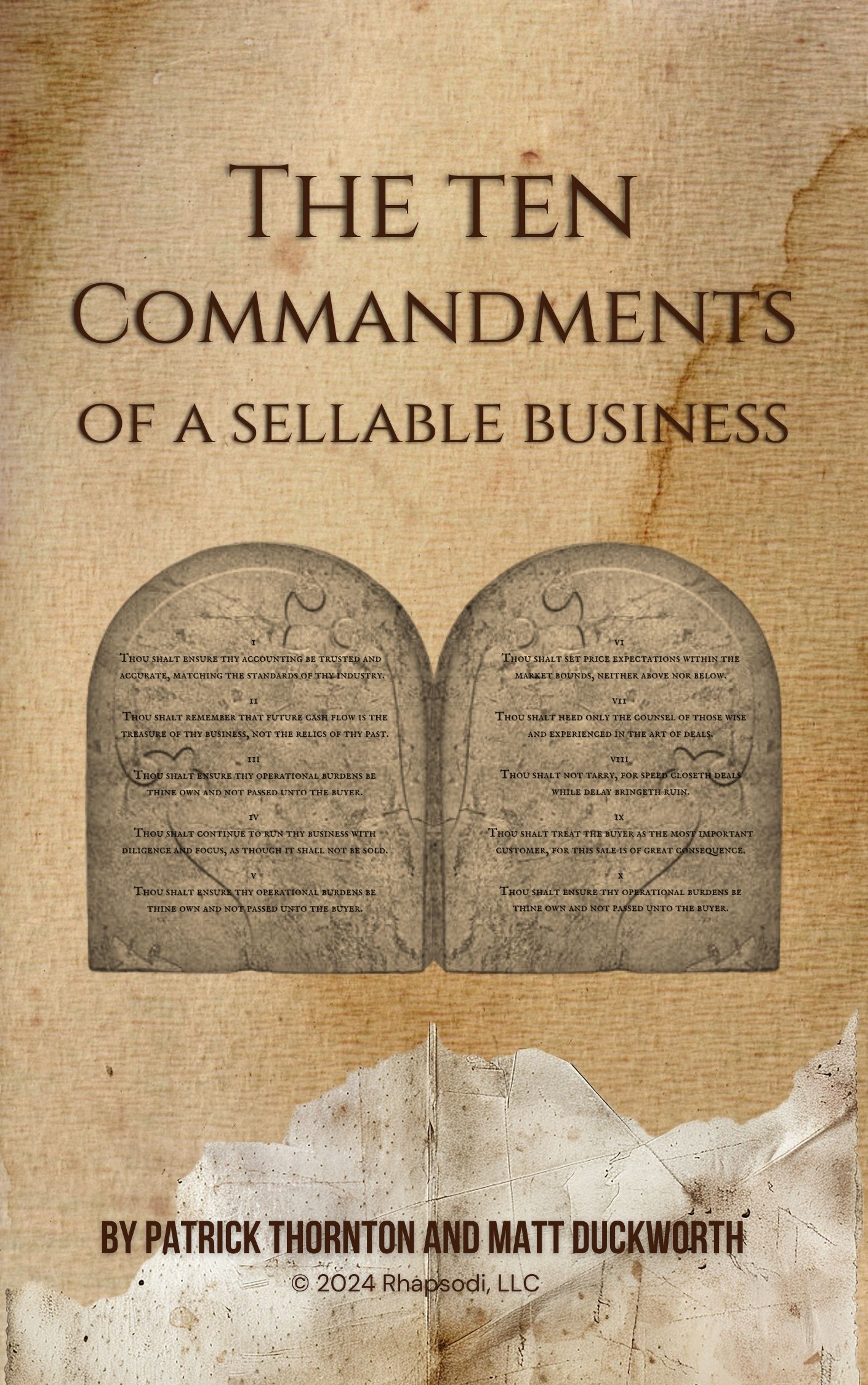

Download your copy of "The Ten Commandments of a Sellable Business" now.

Our Wake-Up Call:

A deal our team was sure to close... until it didn't.

$150,000 commission down the drain.

After this painful experience, we went back to the drawing board to research why deals don’t close. We vowed to avoid these instances in the future. They’re just too costly for everyone involved.

We brought in experts on:

Lean Six Sigma

Constraints Theory

User Experience Design

Sales Flows

And more

We spent over $100,000 on consulting and training sessions to help us understand the issue better, including many late-night conversations about how to think about the system totally differently.

At first we were convinced the problem had nothing to do with us. So, we pointed the finger the other way.

Soon, though, we realized we had far more control over the situation than we originally thought. We simply weren't recognizing the opportunities we had to influence the deals, and lacked the tools in our toolbox to do so.

As we analyzed these lessons, we began to ask other M&A professionals about their experience. We found a resounding “Yes, you’re right!”

We then went to the Exit Planning Institute to see if their information matched what we’d come up with.

To our surprise, it matched.

Here are some basic stats we learned:

On average, only 3 out of 10 businesses listed for sale will actually change hands.

Of the 7 that don’t, deal advisors had the ability to control the outcome on about half the deals through better and more diligent work.

These extra 2-3 “failed deals” that brokers could have controlled represent, on average, over $200,000 per year in additional income potential.

The leading causes of broker-controllable deal failure:

▫️ Bad financials – Can be cleaned up quickly with a capable referral partner. The ROI can be easily quantified to help business sellers understand the importance.

▫️ Unrealistic price expectations – Can be mitigated by using better comp methods and a more structured way to get sellers to agree to a price.

▫️ Lack of seller financing – Can be overcome by a more structured approach to seller conversations.

Avoid Deal-Killing Mistakes: Get The Ten Commandments of a Sellable Business now!

Join hundreds of other M&A pros elevating their game.

Meet our team:

Over the last 40 months our firm has helped clients, on average, grow profits by over 100% by improving operations and implementing smarter financial strategies, while assisting them grow their private business portfolios through acquisition.

Matt Duckworth

Former CFO to rapidly growing businesses and founder of Rhapsodi, a fractional CFO & financial analysis agency specializing in helping brokers and M&A professionals.

Patrick Thornton

Experience as CEO and Founder of Manufacturing Startup. Presently, Head of Finance at Rhapsodi, specializing in providing operating KPI's and fundamental deal analysis.

© 2024 Rhapsodi, LLC. All rights reserved.