Empowering You with Smart Healthcare Options

Delve into the most affordable medical scheme for the next generation of young professionals, provided by the premier healthcare provider in South Africa.

Affordable

Personalised

Optimised Benefits

Flexible

Affordable Pricing

Active Smart offers access to high quality healthcare providers with risk funded day-to-day benefits at the most affordable price point in the industry at only R1,350 per member per month.

Healthcare needs

Full cover for emergencies in any private hospital.

Unlimited hospital cover for admissions in the Dynamic Smart Hospital Network. Specialist reimbursement rate for hospital admissions at 100% of the Discovery Health Rate.

Healthcare wants

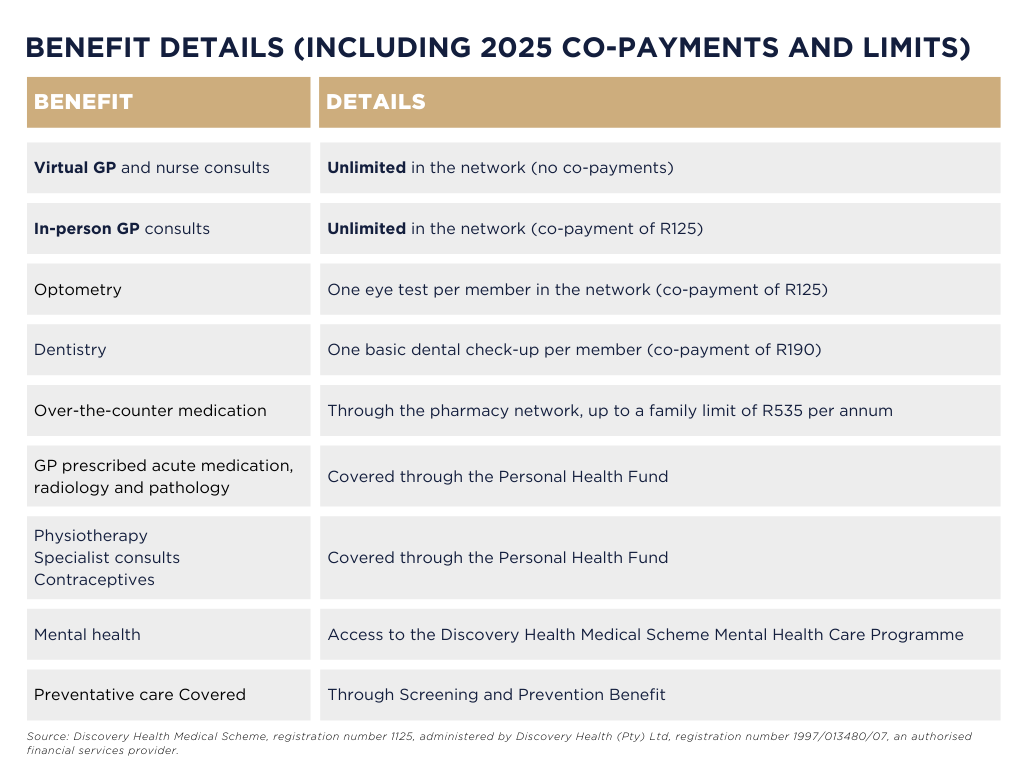

Day-to-day benefits include:

Unlimited GP Consults

Dental Check Up

Eye Test

Over-the-counter medication

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

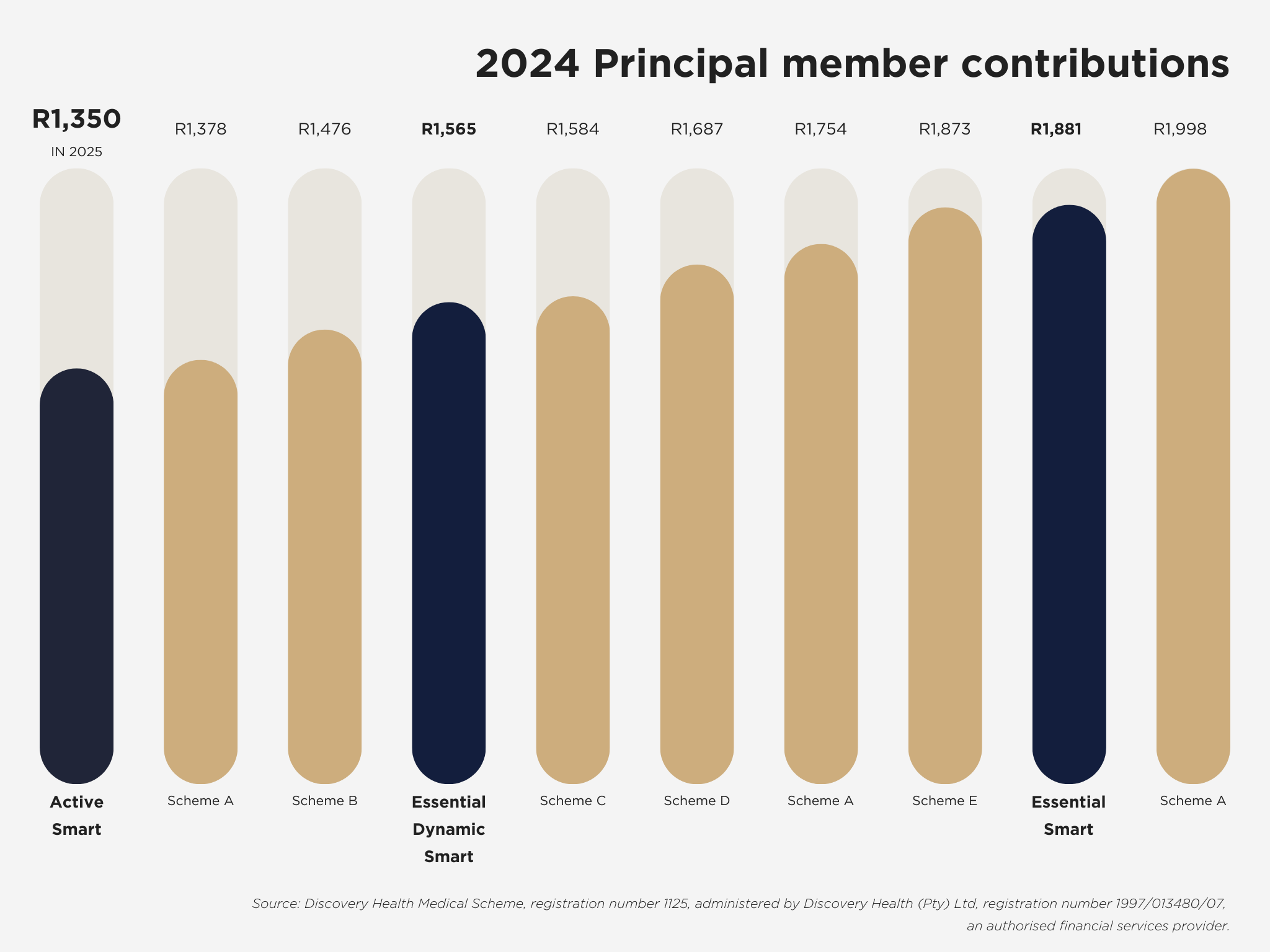

Active Smart: Affordable Pricing

R1,350 per month

At the start of your career, every cent matters. The Active Smart plan offers the industry's most affordable option for young professionals like you. Take a look at the graph comparing monthly contributions of competitor healthcare schemes – the Smart Active option stands out as a clear value leader. Put your health and wellness first without delay.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

Active Smart:

Healthcare Needs

Did you know that there is a 36% higher incidence of trauma events between the ages of 18 and 30 compared to other ages, with an average claim cost of R78,000 per admission?

Accidents happen.

With Active Smart, you have full cover for emergencies in any private hospital.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

Active Smart: Member Benefits

Unlimited hospital cover for admissions in the Dynamic Smart Hospital Network.

Standard deductible of R7,500 * per hospital admission for elective non-PMB admissions.

But don't worry. We've got you covered.

Specialist reimbursement rate for hospital admissions at 100% of the Discovery Health Rate.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

Don't Mind The Gap

Affordable, essential protection for young professionals who need peace of mind when it comes to healthcare costs.

From + R49 per month

For those younger than 30 years

From R99 / month for those between 30 - 40 years

Gap Active covers the common medical expense shortfalls that can arise during hospitalisation.

In-Hospital Specialist Gap Cover

Additional 100% of medical scheme rate taking in-hospital specialist cover up to 200%

Procedural Deductible Cover

Full cover for elective Active Smart procedural deductibles.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

Unlock Fitness & Health

Join the Active Smart Plan Medical Health Scheme today and take control of your health.

From + R145 per month

75% off Gym Membership

25% off Healthy Food

Fully Funded Fitness Device

Get access to one of the largest gym chains in South Africa.

It's more affordable than ever to embrace a fitness lifestyle and join a community just as passionate about health as you are.

You get more than just gym access - you’re joining a movement.

Why wait? Be First. Be Fit.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.

Be the first to be part of the Healthcare Evolution.

Apply Now.

Unsure if the plan is right for you?

Don't worry, we got you. Here are some answers for your questions.

Still not sure? Click below and send us an email request.

Does the Active Smart plan include cancer benefits?

Yes, you have Prescribed Minimum Benefit cancer coverage when using a network provider. All cancer-related healthcare services are covered up to 100% of the Discovery Health Rate. However, you may need to make a co-payment if your healthcare professional charges above this rate.

Please contact us for more information about the Oncology Benefit.

Would my new plan cover chronic medication?

Active Smart provides coverage for a specified list of 27 medical conditions, known as the Chronic Disease List (CDL). Please note that the Chronic Drug Amount (CDA) does not apply to the Smart plans, and only medications included on the formulary will be covered.

Feel free to contact us to discuss the medicine list for the Chronic Illness Benefit (formulary).

Are there any additional co-payments required for the cancer benefit?

To avoid a 20% co-payment, you must obtain your approved oncology medication from a designated service provider. Please consult your treating doctor to ensure they are using our designated service providers for your medication and for any treatments you receive in their rooms or at a treatment facility.

Would our pregnancy be covered?

Yes, in-hospital would be covered, but note:

Neonatal admissions are limited to R70,000.

Elective caesarean section is excluded, except if medically necessary.

The Discovery maternity benefit, covering day-to-day benefits, is not covered on the Active Smart plan.

Would scans be covered?

Scans may not be covered. For MRI and CT scans, if they are not related to your admission or if they are for conservative back and neck treatment, you will need to pay for them in full.

Are all hospitals covered?

For planned admissions, you need to choose a hospital from the Hospital Network.

To find the most appropriate hospital conveniently located near you, please use the Medical Provider Search tool available on the Discovery Health app or website.

Please note that this requirement does not apply in emergencies. For emergencies you would enjoy full cover in any Private hospital.

Healthcare services that are not covered on your Active Smart plan

Extra exclusions, but not exclusive to the following*:

Back and neck treatment or surgery

Knee and shoulder surgery

Joint replacements

Elective caesarean section

*Except where required as part of a defined benefit or under the Prescribed Minimum Benefits.

But don't worry. We've got you covered. Click the button below to find out more.

Source: Discovery Health Medical Scheme, registration number 1125, administered by Discovery Health (Pty) Ltd, registration number 1997/013480/07, an authorised financial services provider.

For more information refer to the Discovery Health Smart Plan 2025 Brochure.