🇪🇺 Tailored for Europe

Financial Compliance Regulatory Consulting

Get your free initial online meeting with one of our advisory experts, lasting around 45 minutes. This can be done by phone or video call. What is your case?

Free initial online meeting

With one of our advisory experts

45 minutes just for your case

Who We Are

Bascom's Folly Solutions is a financial services regulatory & business development consulting firm for innovative Fintech and financial services businesses.

With our team’s experience working in various positions at the Central Bank and several financial companies, we help our Clients to launch Fintech ventures from 0 to 1, acquire:

Payment Institution (PI);

Electronic Money Institution (EMI);

Specialized Bank (SP);

Bank, Asset Management (AIFMD),

licenses and other licenses in Europe, do market research, define the appropriate business model and products, identify risks, create AML, KYC / compliance internal procedures and provide the bridge between financial technology platforms and financial markets regulations. We have an excellent understanding of possible stress points for any type of Fintech / Asset management business model and can help the Client to tailor various financial solutions.

Our Services & Solutions

Feel free to share your case with us

Step-by-Step Support for Financial Licensing Success

Structured and tailored for:

Payment Institutions (PI)

Electronic Money Institutions (EMI)

Specialized Banks

Asset Management Companies

Financial Business Plan

A business activity plan for at least the first three years, including routine and stressful situations, banking activities and a description of organizational structure and internal control function, initial and continuous activity model viability and competitiveness, target market, products, sales channels, operational and regulatory risk factors, including money laundering and terrorist financing risks and how they shall be managed, confirmation that the bank has a plan for the transitional period pending the capacity to fully carry out the functions, and a description of the plan, strategic objectives and strategies for achieving them, a description of the competitive advantages and disadvantages, etc.

Financial Estimate2

Financial projections and statements at the level of the bank and, where applicable, of the consolidated group including existing and future debts of the bank prior to the commencement of banking activities; collateral, guarantees or indemnities provided or intended to be provided by the bank prior to the commencement of banking activities; the rating of the bank and, if applicable, the overall rating of the consolidated group; analysis of the extent of consolidated supervision; description of the risk management system, including risk limit system, credit and lending risk taking, interest rate and settlement risk management, liquidity and concentration risk management, and diversification policy, provisioning compilation, collateral management, dividend allocation; draft of the accounting policy and a detailed description of the accounting system; a bank resuscitation plan prepared in accordance with the Resolution No. 03-209 of the Board of the Bank of Lithuania of 29 December 2015; description of the Internal Liquidity Adequacy Assessment Process (ILLAP), etc.

Legal and Compliance Part

Preparation of documents and the application for SB license, including the incorporation of the company with the governance structure and capital as those which are required for the bank, corporate resolutions of the relevant bodies deciding on applying for the banking license, approving various internal rules and procedures, program of operations including the initial Internal Control Policy, Compliance Function Rules, Internal Audit Regulations, Internal Audit Procedure and Working Regulations of the Audit Committee, Risk Management Function, whistle blowing policy, the conflicts of interest policy, the policy promoting diversity in the management body, the complaints handling policy, the remuneration policy for staff, the systems and policies for assessing and managing the risks of money laundering and terrorist financing, the internal audit resources and an outline of the methodology and internal audit plan, external and intra-group outsourcing rules, and other documents required by the law.

Shareholders and Group Companies Due Diligence

Preparation of the forms about direct and indirect holders of qualifying holdings (>10 percent of shares / votes or ability to exercise significant influence up until UBOs). Information about proposed managers of the bank including CEO and deputy CEO, CFO, CRO, CTO, which should normally at the same time serve as board members, supervisory council members, internal auditor, etc. Information on licenses, authorizations, registrations or other permits granted by any Member State or a third country authority or other public sector entity in the financial services sector of any group company; the history of litigation and their outcome; information on significant events that have occurred or are taking place and that may reasonably be considered relevant for the application for a banking authorization.

IT System Development to Satisfy Requirements

Mediation in finding an IT system supplier and/ or facilitation of IT system development to meet the requirements for the SB application; Preparation of a detailed description of the IT infrastructure, systems, functions organization, management, security assurance and other systems and controls of the bank including KYC process, Anti-money laundering check tools and databases, anti-terrorist financing check tools and databases, fraud prevention check tools, personal data protection, etc.

HR Management Tailored to Requirements

Facilitation of essential staff recruitment process, preparation of employment contracts, workplace safety consultancy, organization of training programs if necessary, etc. The minimum number of a bank’s management employees must be 10 people. More details could be found above.

European Crypto License

VASP Lithuania: Pioneering Digital Finance in the European Market

Lithuania is a prime location for launching a successful Fintech business.

The country's Bank of Lithuania actively supports financial technology and non-bank payment services, making it a desirable location for companies looking to operate in the virtual currency market.

This environment is particularly conducive for VASP Lithuania operations.

Lithuania is one of the few European Union states that offers a licensing and authorization procedure for virtual currency companies. Although a fully integrated legal framework for cryptocurrencies is still developing.

Lithuania is Proactive in Providing Operational Frameworks for VASP Lithuania Entities

✓ Crypto Exchange License: A company or branch of a company gets the opportunity to exchange digital currency and receive a commission;

✓ Crypto Wallet Exchange: A company or branch of a company can manage customer wallets for the storage of crypto-currency.

Benefits of Obtaining a Crypto License in Lithuania

✓ Opportunity to exchange and store digital currencies with a crypto license in Lithuania;

✓ Access to a favorable environment for fintech startups in Lithuania;

✓ Simplified licensing procedure for obtaining necessary permits in Lithuania;

✓ Separate activities of traditional financial institutions and companies dealing with cryptocurrencies in Lithuania;

✓ Compliance with AML-CTF in Lithuania;

✓ Opportunity for traditional market players to still participate in the turnover of virtual assets.

Our Services Include

✓ Obtaining authorizations of the cryptocurrency exchange operator or the operator of the depository crypto wallets;

✓ Assistance in accounting services;

✓ Memorandum for self-check on applicable Lithuania regulations;

✓ Notice to FCIS;

✓ Management training on internal governance, compliance & responsibilities;

✓ AML-CTF audit preparation;

✓ Compliance audit preparation;

✓ Compliance and DPO outsourcing;

✓ Enterprise-wide AML-CTF risk management assessment;

✓ Preparation of full AML-CTF documents package.

Scope of Supplemental Solutions and Services

More reasonable ways to solve compliance problems with us.

Compliance and Risk Assessment Management Service:

✓ Chief compliance officer function execution / compliance report preparation (every year);

✓ Compliance and other risk management / compliance plan preparation and execution (every year);

✓ Permanent stress testing of compliance function and control monitoring;

✓ Modelation of compliance conduct;

✓ Training courses / material preparation for financial employees;

✓ Direct communication / cooperation with supervisor authority in the name of financial markets participant.

Anti-money Laundering Consulting and Support Services

The review and design of your AML program in a practical and compliant way.

Anti-Money laundering (“AML”) has been at the heart of the regulatory concerns of regulated entities for many years.

In Vilnius, Lithuania and other European jurisdictions, an evolving regulatory environment has obliged such regulated entities to review their AML framework.

We offer AML services which cover the following:

✓ A full independent review of the regulated entities’ AML program;

✓ Certified trainings and awareness sessions for employees and management;

✓ Ad-hoc support in case of remediation plans;

✓ Assistance in the definition of regulated entities' risk-based approach;

✓ Drafting tailored AML policies and Know Your Client checklists.

Finvestment Funds Establishment / Administration & Accounting Service:

✓ Investment funds establishment projects according to various investment strategies, i.e. real estate / private equity / private debt / funds of funds / hedge funds / UCITS, etc;

✓ Investment funds could be established according to UCITS / AIFMD / SIF legal regimes;

✓ Investment funds accounting service (NAV calculation / preparation of financial statements to supervisor authority, etc.);

✓ EMI accounting service (preparation of financial statements to supervisor authority / audit, etc.).

✓ Consultation on all aspects of acquisitions, sales and mergers, i.e. buy-outs (LBOs, MBOs, privatisation other acquisitions);

✓ Structuring acquisitions and divestments (including financing and tax advice); legal and tax due diligence; merger control; shareholder agreements; share and asset sales and other exits; acquisitions and disposals of real estate projects; joint ventures; corporate mergers, de-mergers and other reorganisations; negotiations at all stages; post-acquisition advice.

Meet Our Team

People with varied skills and expertise at your service

Tomas Bagdonas

Founder / CEO

Main experience gained structuring and developing of new investment funds and investment projects in asset management industry (JSC“Orion Asset Management“), including advising on the setting up and structuring, formation of various alternative investment funds, including private equity, real estate and venture cpaital funds, hedghe funds, funds of funds, private debt, retail funds (UCITS) and other types of investment funds;

More information

✓ Furthermore, Tomas advised asset managers on issues related with MiFID II regulation, i.e. conduct of business rules in the field of investment scheme management, other various matters regarding to the asset management and capital markets regulation / portfolio management services. Solid practise was gained by building full compliance internal mechanisms for the financial markets participants within Lithuania and EU financial markets regulation model;

✓ Tomas supervised more than seventeen private investments funds managed by investment mangers, from establishment stage till the end of the life cycle. Moreover, Tomas gained powerfull know-how working in Lithuania Bank Financial Services Supervision Unit and in TOP –TIER Baltic Law Firms. He is educated financial services lawyer in Lithuania and in Washington D.C., USA.

Personal investment projects

✓ Established close-ended real estate investment fund designed for informed investors "Orion London Property Fund" (04/2015); Established close-ended real estate investment fund designed for informed investors "Orion RE Development Fund"(08/2015); Established close-ended real estate investment company designed for informed investors "Orion Healthcare and Wellness Fund" (09/2016)

✓Established open-ended investment fund designed for informed investors "Orion Funds of Hedge Funds" (10/2016)

✓Established close-ended real estate investment fund designed for informed investors "ORION Kaunas Opportunity Fund I" (2016)

✓Established close-ended real estate investment fund "USA Property Value Fund" (2016)

✓Established close-ended private equity investment fund designed for informed investors "Orion Private Equity Fund I" (2017)

✓Established close-ended private debt investment fund designed for informed investors “Orion Baltic High Yield SME Fund” (2017).

Titas Budrys

Advisor For Fintech Companies Development

Mr. Titas Budrys is co-founder and CEO of Seven Seas Europe, a licensed Electronic Money Institution in Lithuania and subsidiary of Seven Seas Global Group Limited, Hong Kong.

Mr. Budrys is also a Chairman of the Board of association Fintech Hub LT, which unites 36 Fintech industry participants in Lithuania.

More information

Previously, Mr. Budrys worked as an Adviser to Board Member at the Central Bank of Lithuania, which is part of Eurosystem of Central Banks in the European Union and has taken parts in the projects in the areas of payments and research. He also has some experience in Investment Banking within the DNB Bank.

Titas holds a Master of Arts degree in Financial Economics from the University of St. Andrews.

Jegor Menkov

Marketing Strategy Development Advisor

Jegor Menkov is an advisor and creator of long-term marketing strategies.

CEO of "Menkoff Solutions."

He has over 10+ years of experience working with businesses from various industries, helping them implement their marketing strategies.

More information

More about "Menkoff Solutions":

For over 10 years, we have been working with businesses from various industries, helping them implement essential digital marketing and WEB development solutions.

✓ Consulting;

✓ Digital Marketing;

✓ WEB Development;

✓ Digital Advertising;

✓ Strategy Planning;

✓ Support and Maintenance.

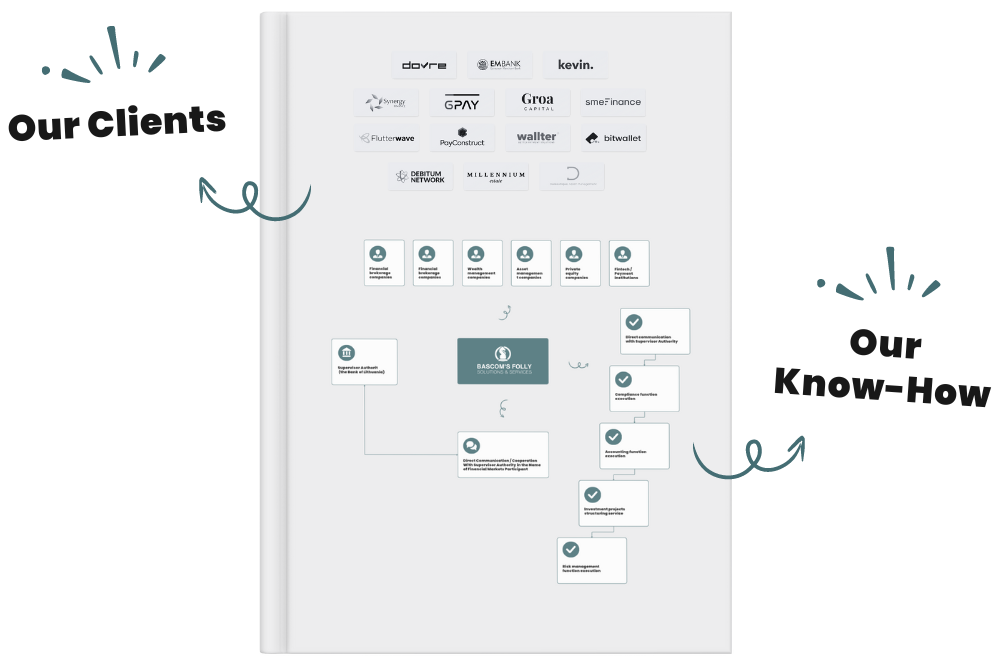

Access Our Know-How Solutions Presentation

Get your free initial online meeting with one of our advisory experts, lasting 45 minutes, including a presentation.

Get Your Free Initial consultation

Let's set up our first online meeting

100% guarantee of your personal data protection and confidentiality. Fully compliant with all GDPR regulations.