Track your expenses.

Save money.

— CleverCash Early Access —

Already signed up and ready to go?

Want in?

Join our Early Access and take control of your spending.

CleverCash is a simple expenses tracker — for now.

The goal is to grow it into a powerful app for anyone juggling multiple bank accounts and wanting a clear view of their cash flow. Whether it’s everyday spending or long-term financial planning, CleverCash helps you understand where your money is going.

Right now, the app supports uploads of .tsv files, but more formats like CSV and standard bank exports (like MT940 and CAMT053) will be added soon.

The early birds

Welcome to the CleverCash Crew 😎

If you're seeing this page that means you're one of the first users of CleverCash and get to shape the app in a major way by sharing your findings and feedback with me.

As a thank you to early adopters and members of the early access program you are eligible to a:

Solo plan: Free

50% off your first year (Family plan for unlimited accounts €29.00 €14.50)

50% off lifetime subscription (Family plan for unlimited accounts €59.00 €29.50)

€5 gift card for each referral, with up to 10 referrals (if your referrals sign up for an annual or lifetime subscription)

Instructions

How it works

Download the transaction data here: testdata.tsv

Store the file in a location you can easily find again like "Downloads"

Go to https://test.clevercash.nl and login.

Note: Only users that registered upfront have access to the app. If you haven't yet, please sign up before going on to the next step.

Upload the testdata.tsv file through the interface on the "Upload" page

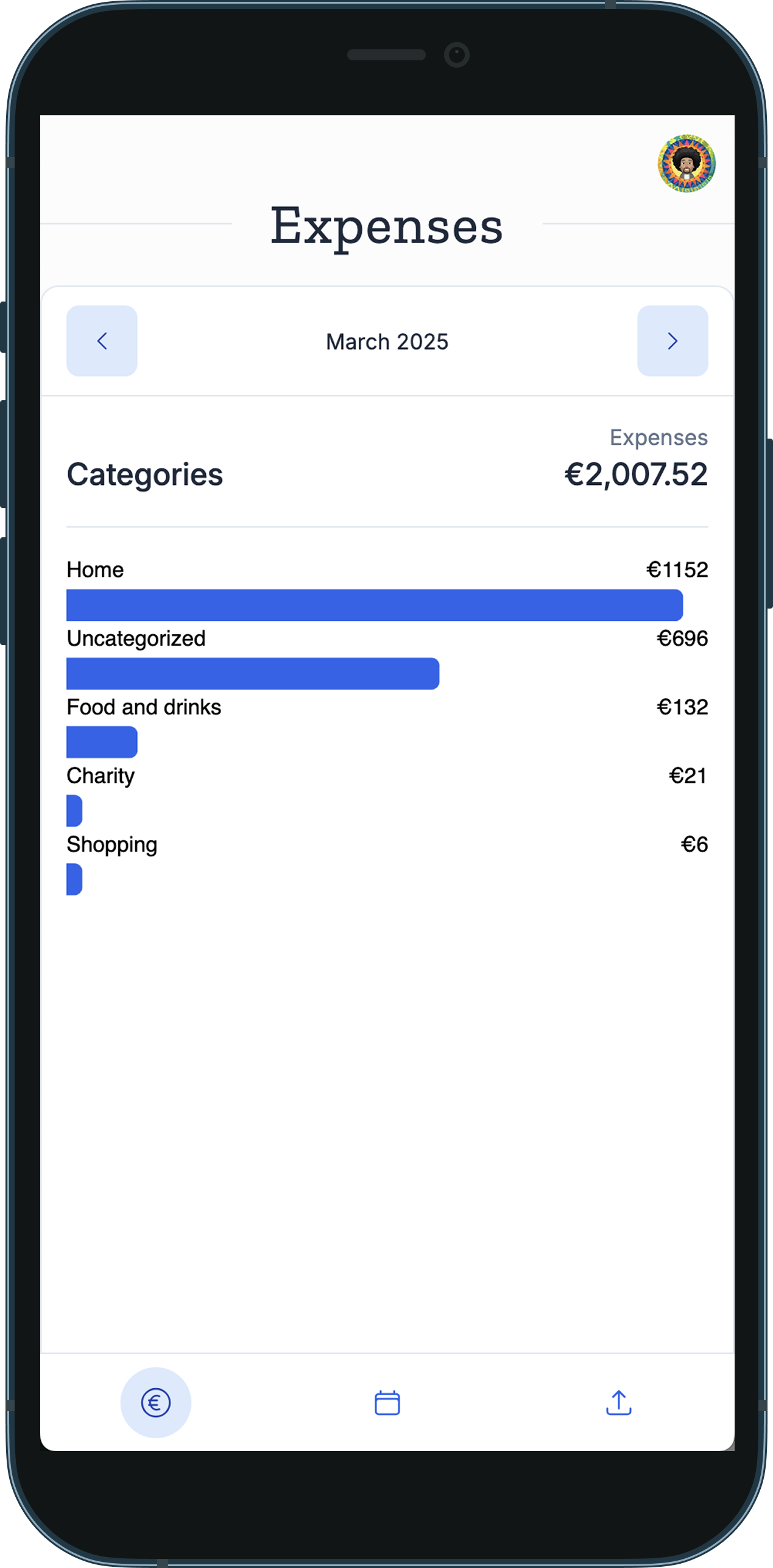

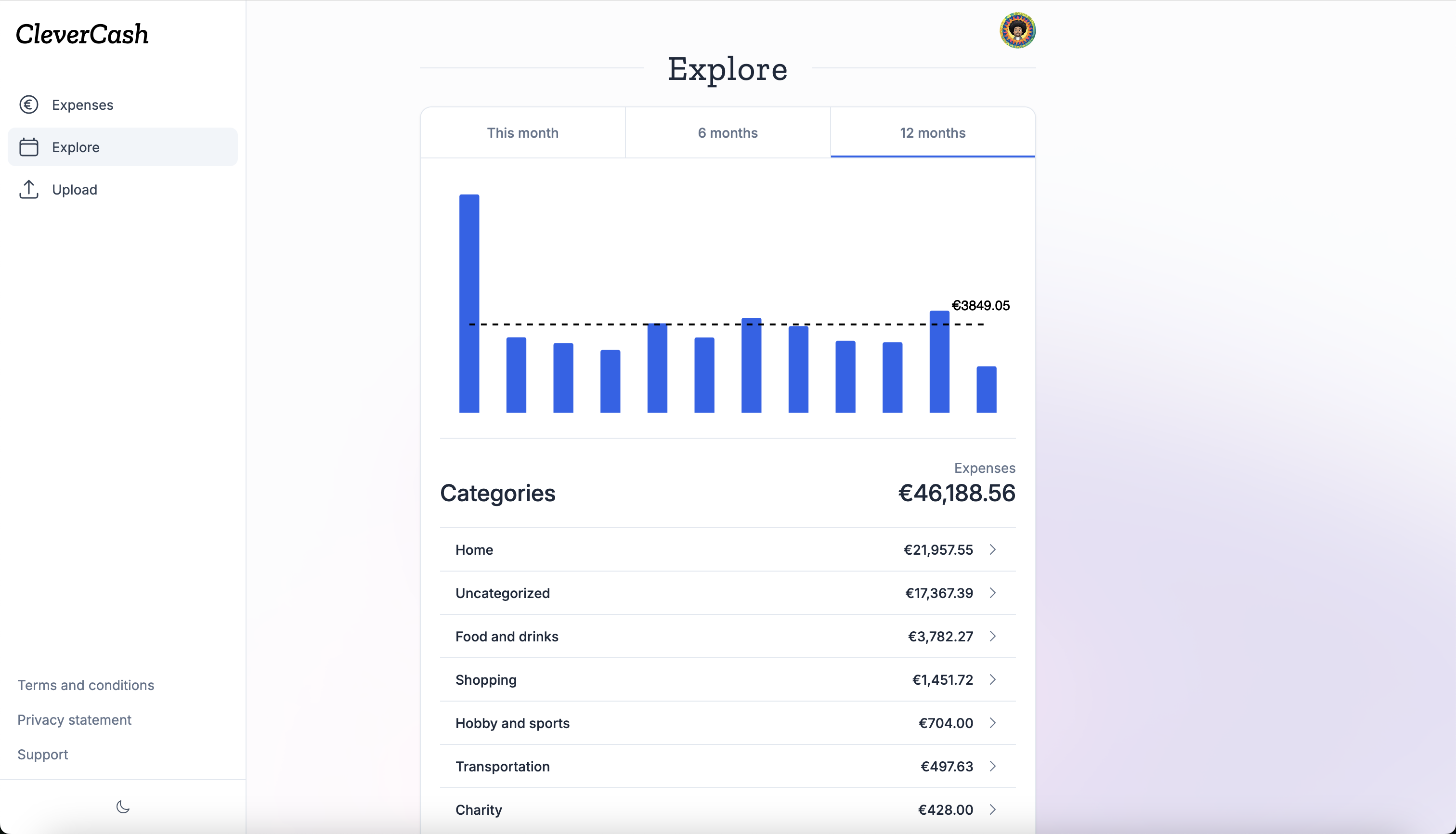

When the upload was successful you can go to the "Expenses" page and start categorizing the transactions

Categorization is done by clicking on the "Uncategorized" bar of the transactions chart. It's recommended to categorize transactions on a month-to-month basis via the “Expenses” page, but feel free to follow your own intuition and explore the app.

Have fun and let me know what you think, but above all let’s be clever with our cash 💡💰

Ready to get started?

Did you know CleverCash can be used as an app on any device? Simply follow these instructions to install it as a Progressive Web App

Get it touch

Reporting bugs and giving feedback

As the app is currently in early access and is still actively being developed, please report any missing features or strange behavior here.

I'll make sure to get back to you as soon as possible.

Heads up

Known bugs and limitations

iPhone 13 users are reporting an issue where they get a blank page when trying to access the app. This is being investigated.

If you upload test data again it will not be categorized automatically. You'll have to do that again for the “new” transactions. Adding this feature is on the top of my to-do list :)

Switching between light and dark mode can cause an issue where text on the charts isn't properly updated. I'm still investigating this issue and will fix it ASAP. For now you can manually toggle the theme and the text on the chart should be visible again…

I've spent a fair bit of time generating the test data, but it can always be improved with expenses in categories I didn't think of or didn't anticipate like car owners or people with kids will find that stuff like trips to the repair shop or childcare payments are missing. Let me know what I can add to the next version of dummy data or if you're so inclined feel free to add it yourself to make it suit your own needs. Feel free to share! Generating test data can be time consuming.

Currently the app only supports a single account, so all transactions are part of one big pile of data. Later on you can add and manage multiple accounts so you can see all your financial assets in one convenient place.

The links “Terms and Conditions”, ”Privacy statement” and “Support” are just placeholders and don't work yet.

Currently users can't sign out of the application and your session will not renew. After 15 minutes you're automatically signed out. This can be annoying if you're in the middle of a categorization session, but it's a security feature which is intended to protect your account and your data.

FAQ

Your questions answered

Find quick answers to common queries about CleverCash.

This is a the format I chose because it looked like the easiest to work with that ABN Amro offered from their download page. That means the first version of the app will only be accessible to ABN Amro users.

Behind the scenes I’m working on connecting to these banks so that users don’t have to upload their transactions anymore. Unfortunately that process is more time consuming and requires certification that I only want to invest in if Initial feedback for the beta is positive.

For now I'd advise against it.

Security and privacy are the focal point of any service that works with this type of sensitive data and I'm putting a lot of care and attention into building a secure and robust service.

The goal of this early access launch on a test environment is to test the functionality and robustness and I'm expecting to improve these aspects in the coming weeks based on the insights I will gain by talking to the first batch of users.

If there are no concerns raised during testing I'll give the green light through one of my newsletters.

In short: Wait for the green light before uploading your own data :)

I'm still on track to launch towards the end of Q2. If you want to stay updated on the journey towards the launch, I'm posting on LinkedIn and BlueSky about my progress so give me a follow if you want to be kept in the loop.

That's all folks!

Thanks for checking out CleverCash ❤️

Now that you're done sorting out your finances, don't forget to enjoy life and spend some time with your loved ones.

After all that's what financial freedom should be about: Not having to worry and making time for the things you care about.

Cheers!

— Florestan